Why Eagle Pass?

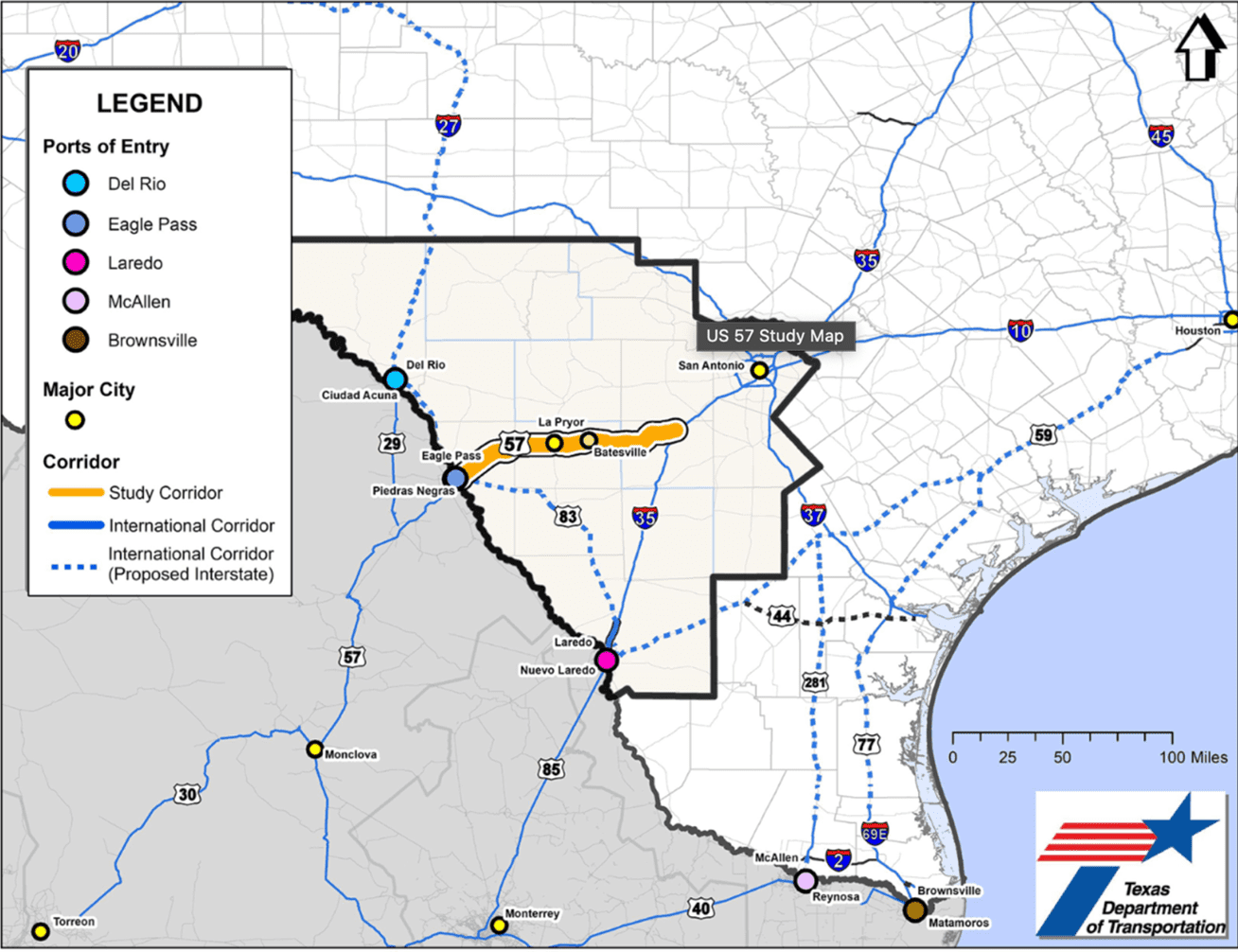

A future consideration regarding U.S. – Mexico border crossings involves the uptick of cargo transportation across Mexico from seaports to the U.S. via border crossings in Eagle Pass, Laredo, and beyond. Mazatlan, situated on Mexico’s western coastline, boasts a direct roadway network connecting it to Piedras Negras and Eagle Pass. Consequently, the Eagle Pass border crossing has emerged as an increasingly popular port of entry.

In addition to the need to ease pressure on other trade routes connecting seaports and U.S.-Mexico inland ports, safety has become a major concern for transport trucks in Mexico. In recent years, incidents of cartels and organized crime hijacking essential cargo transportation have escalated in neighboring Mexican states. The overall Eagle Pass border crossing trade route presents a viable solution by eliminating an excess of obstacles to and from Mazatlan for cargo traveling to or from its seaport. This route circumvents the regions of Chihuahua, Nuevo Leon, and Tamaulipas, providing a safer alternative for trade transportation.

In July 2022, Mexican representatives extended an invitation to a select group of TXDot employees and consultants for a comprehensive tour of various facilities in Coahuila. The study team’s itinerary included visits to Torreon, Saltillo, and Piedras Negras, all strategically positioned along the U.S.-Mexico trade route to and from the Eagle Pass Point of Entry. During the visit, the team had the opportunity to engage in discussions with Coahuila Governor Miguel Ángel Requelme SolÍs, key stakeholders, and fostered coordinated efforts with Mexican Partners. The tour encompassed significant industrial sites such as the Peńoles Mining Company, Chrysler Plant, Daimler Freightliner Plant, General Motors Plant, and Constellation Brands Plant. This immersive experience provided invaluable insights into the origins of cross-border trade and the intricate navigation of freight to the border. The study team noted a pronounced demand transportation infrastructure in both Texas and Mexico, attributed to the effects of reshoring/nearshoring.

Eagle Pass is Poised to emerge as the next bustling hub for international commerce between the U.S. and Mexico. As other border crossings in Texas become increasingly congested, Eagle Pass presents a vital solution, particularly considering that nearly 80% of trade passing through the three international border crossings of Laredo, Eagle Pass, and Del Rio is transported by truck. The growth of Eagle Pass as a prominent trade route will unlock a previously underutilized avenue, addressing the longstanding issue of inadequate infrastructure. Moreover, it will alleviate the strain on heavily trafficked highways in Mexico. Geographically positioned to serve as a gateway, the Eagle Pass Port of Entry will streamline trade operations for regions west of Nuevo Leon, offering significant savings in both time and money.

It is important to acknowledge the existing robust infrastructure supporting trade already between Mazatlan and Eagle Pass. Notably, the highways connecting these points are well-developed and capable of accommodating increased heavy commercial traffic. Moreover, the border facilities at Eagle Pass surpass those at other points of entry in Mexico, boasting effective equipment and capacity. This advantage translates into the ability to handle substantial trade volumes efficiently, while simultaneously reducing wait times and enhancing safety measures.

There are four major factors in the eminent explosion of the Port of Eagle Pass.

1.

The Camino Real International Bridge Realignment Project stands as a significant initiative geared towards bolstering commercial traffic efficiency and safety, while also stimulating economic growth in Eagle Pass. With a proposed budget of $19.5 million, this expansion is poised to comprehensively address various transportation challenges and establish a more streamlined access point to the Port of Entry. The anticipated benefits extend beyond mere infrastructure enhancements; they are expected to usher in new economic opportunities, particularly with the heightened utilization of this secondary trade route. Such developments will spur increased demand for premier industrial parks such as EMPIRE. With construction scheduled to commence on the bridge in October 2024 and an estimated completion timeframe of two years, those with interest in Eagle Pass can anticipate tangible improvements in both infrastructure and trade facilitation upon construction completion.

2.

Construction of the Sinaloa Port (SIPORT)is the closest point to the Pacific in the Eastern United States, which means that 70% of its economy. It is also the closest port to the north of Mexico, representing 30% of its Gross Domestic Product.

3.

The realization of the U.S.-Mexico-Canada Agreement corridor, this being the logistic connection that, added to the Inter-oceanic Corridor – Istmo of Tehuantepec, enhances the economic development of Mexico.

- Exit to the Pacific that connects the North of Mexico and the East of the United States.

- Elevated cargo flow projection between the United States and Mexico by 2050 currently sits at 608 billion dollars.

- Heightened economic prosperity of all States involved.

- Mexico will be the most important link between the United States and Asia.

- Contributions to the Mexico-United States migration agenda.

4.

The US 57 Corridor will become a highway marking the connection point between Eagle Pass and central Texas via Interstate 35.